Obtaining fast title loans in Texas is accessible despite bad credit, with lenders valuing vehicle collateral over credit history. The process involves inspection, ID, and income verification. Reputable, licensed lenders like those offering Dallas or Houston title loans prioritize transparency. Online reviews and secured loans can enhance safety. A simple online application, credit check, and instant funding ensure swift access to cash for eligible Texas residents.

Looking for a swift financial solution in Texas? Fast title loans could be your answer. This article guides you through the process of securing these loans, offering a fast and convenient way to access cash. We’ll explore the key requirements, help you find reputable lenders in Texas, and outline the simple application steps for quick approvals. Get ready to unlock the potential of fast title loans and gain control over your finances today.

- Understanding Fast Title Loans Texas Requirements

- Locating Reputable Lenders for Fast Title Loans Texas

- The Application Process for Swift Approvals

Understanding Fast Title Loans Texas Requirements

Understanding Fast Title Loans Texas Requirements

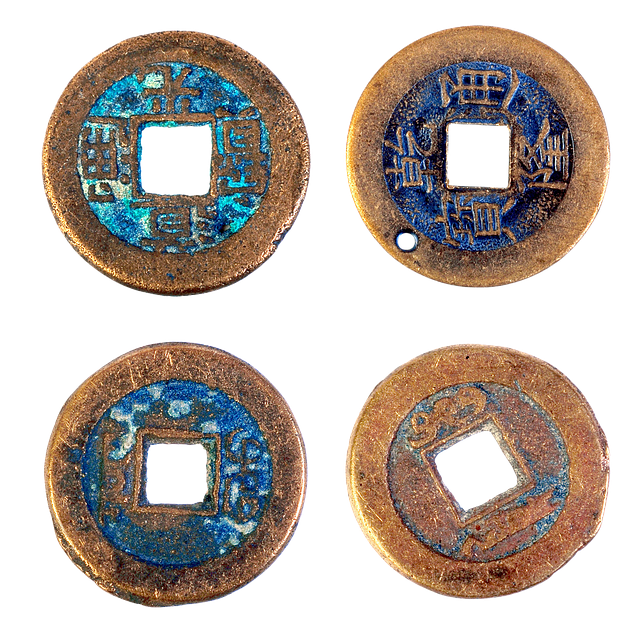

When considering a fast title loan in Texas, it’s important to grasp the basic requirements set by lenders. These loans are designed for borrowers who own a vehicle and need quick cash access. The primary security for such loans is the vehicle, which means the lender will conduct a thorough vehicle inspection to assess its value. This process ensures that the collateral is sufficient to cover the loan amount requested.

In Texas, fast title loans are available even for individuals with bad credit, as lenders focus more on the value of the vehicle than on the borrower’s credit history. The application process typically involves providing proof of ownership, a valid driver’s license, and possibly some other basic identification documents. Lenders may also ask for income verification to ensure the borrower can repay the loan. Understanding these requirements beforehand can streamline the process and help you secure your fast title loan in San Antonio or any other part of Texas more efficiently.

Locating Reputable Lenders for Fast Title Loans Texas

When looking for fast title loans Texas, it’s paramount to focus on locating reputable lenders. This ensures a transparent and secure transaction. Start by checking online reviews and ratings from platforms dedicated to financial services. Websites like Trustpilot or Better Business Bureau (BBB) offer insights into the lending practices of various institutions. Look for companies with consistent positive feedback regarding their loan processes, interest rates, and customer service.

Moreover, considering well-established and licensed lenders, such as those offering Dallas title loans, can provide an additional layer of protection. Licensed lenders adhere to state regulations, safeguarding you from predatory lending practices. Additionally, explore options for secured loans, which use your vehicle’s title as collateral, potentially offering lower interest rates compared to traditional bad credit loans. Ensure the lender is transparent about terms and conditions before proceeding with a fast title loan in Texas.

The Application Process for Swift Approvals

The application process for fast title loans Texas is designed to be swift and efficient, catering to those in need of quick financial assistance. Applicants can initiate the process by completing an online form, providing essential details about their vehicle’s information and personal data. This digital approach streamlines the initial step, eliminating the need for extensive paperwork typically associated with traditional loan applications.

Once submitted, a representative will review the application, conducting a quick credit check to assess eligibility. Houston title loans, renowned for their speed, often have lenient criteria, making it possible for many individuals to gain approval. After verification, the funds are promptly deposited directly into the borrower’s account, ensuring they receive the much-needed cash within a short time frame.

When seeking fast title loans Texas, understanding the requirements, locating reputable lenders, and navigating a streamlined application process are key to securing funding promptly. By adhering to these steps, individuals can access much-needed financial support in a fraction of the time typically associated with traditional loan options. Remember, when it comes to fast title loans Texas, knowledge is power, and an informed borrower is better equipped to make intelligent decisions regarding their financial future.